What is “Trickle Down Economics?”

The theory that financial benefits given to the wealthy will pass down to everyone else1. Policies include income tax reduction, tax cuts for the rich, and deregulation.

The idea behind trickle-down economics is that investors, company owners, and those with a lot of capital are the true drivers of growth. These entities will use extra money to stimulate the economy and create new jobs, and that expansion will trickle down to workers.

However, this theory has been proven to benefit only one group: the rich2.

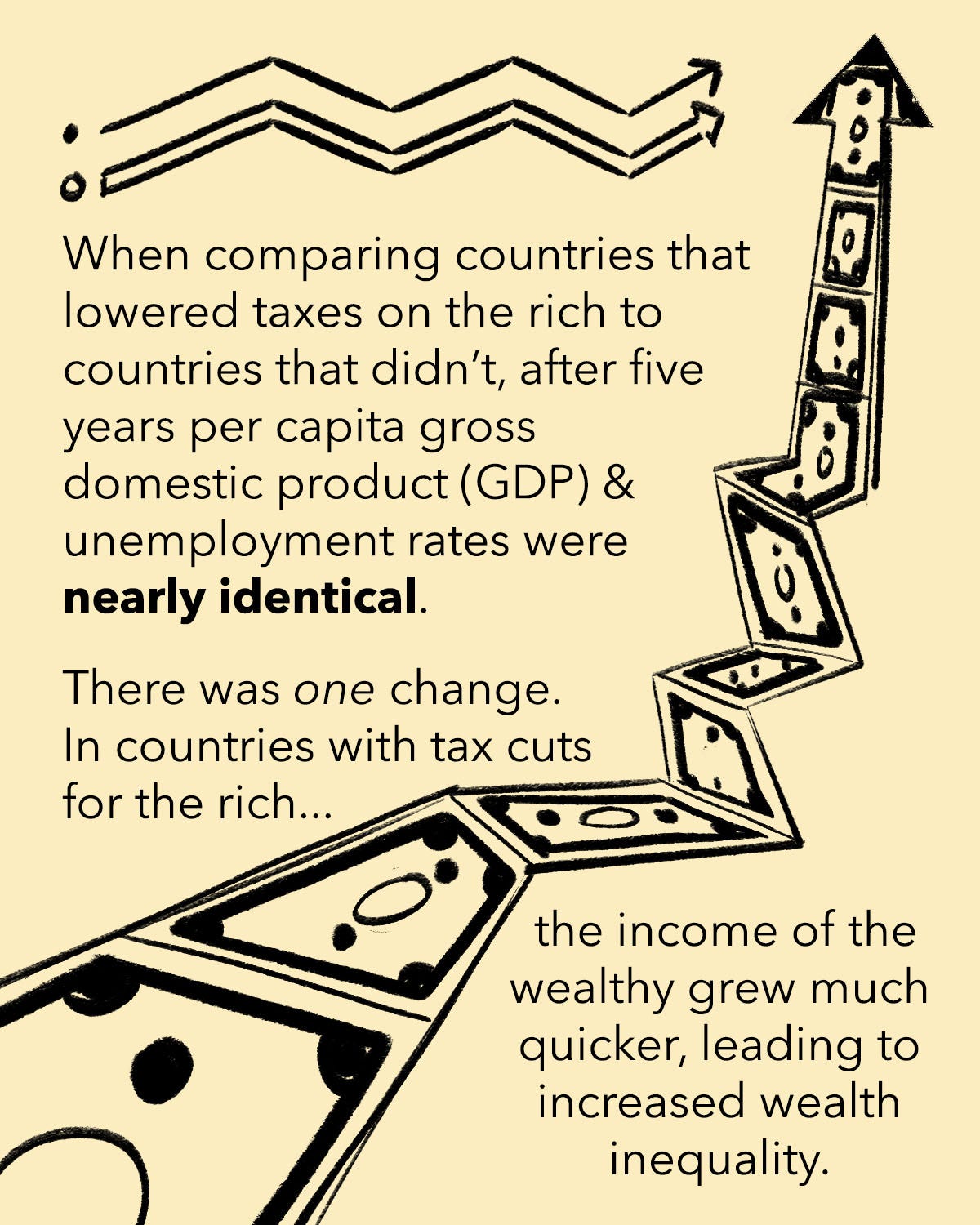

A study from the London School of Economics examined 18 developed countries over 50 years from 1965 to 2015. The study compared countries that passed tax cuts in a specific year, for example, the U.S. in 1982 under the Reagan administration, with countries that didn't.

The results showed that after five years per capita gross domestic product (GDP) & unemployment rates were nearly identical.

There was one significant change shown in the data. In countries with tax cuts, the incomes of the rich grew much faster, severely exacerbating wealth inequality.

Trickle-down economic policies severely exacerbate wealth inequality; the rich get richer, while the poor see little to no improvement in their finances.

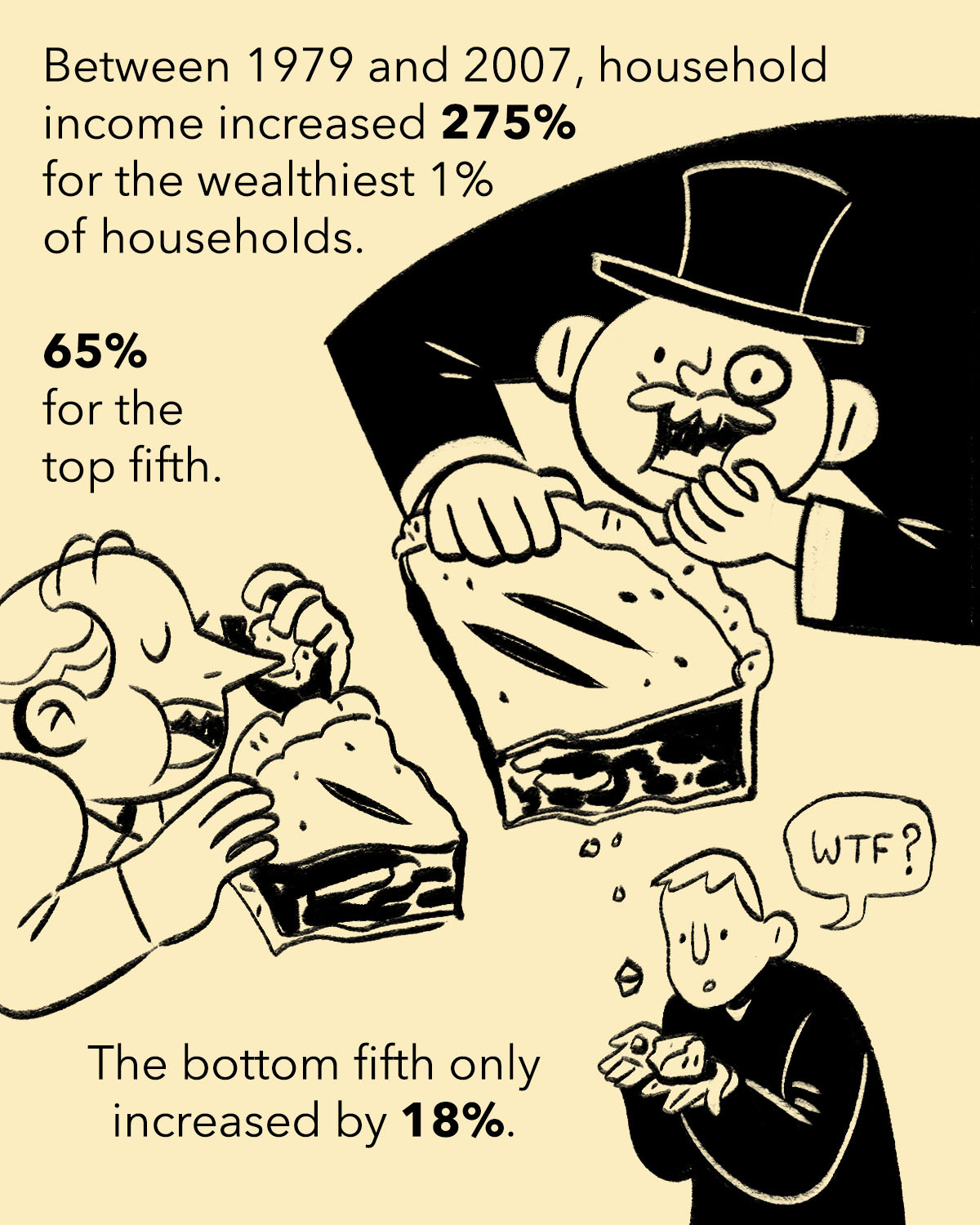

For example, between 1979 and 2007 household income increased 275% for the wealthiest 1% of households, increased 65% for the top fifth, while the bottom fifth only saw an 18% increase.4

This calculation is true even after taking "wealth redistribution," into account– subtracting all taxes, adding all income from Social Security, welfare, and other payments5.

Proponents claim companies will use their accrued wealth to stimulate the economy and create new jobs, but what actually happens is that most of corporate profits go into stock buybacks.

A stock buyback is when a company repurchases its own shares, leaving the remaining shareholders with a bigger cut of the company and inflating the value of the share prices6.

This practice was illegal in the US and considered a form of market manipulation, until 1982 under the Reagan administration.

Behind many stock buybacks are massive layoffs. In the aftermath of Trump tax cuts, corporations used their savings to buy back shares of their own stock while also firing thousands of workers. To name a few, in 2018 Lowe’s spent $10 billion on buybacks, Walmart spent $20 billion, and AT&T repurchased $419 million. All three fired thousands of workers7.

Between 2019 and 2023, the 100 companies in the S&P 500 with the lowest median wages spent $522 billion on buybacks8. The tremendous cost of these stock buybacks would have paid the salaries of every laid-off worker for decades9.

Works Cited

1-“Trickle-down theory.” Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/trickle-down%20theory. Accessed 13 Nov. 2024.

2- Hope, David, and Julian Limberg. The Economic Consequences of Major Tax Cuts for the Rich. 2020.

3- Picchi, Aimee. “50 Years of Tax Cuts for the Rich Failed to Trickle Down, Economics Study Says.” CBS News, 17 Dec. 2020, www.cbsnews.com/news/tax-cuts-rich-50-years-no-trickle-down/.

4- Congressional Budget Office. Trends in the Distribution of Household Income between 1979 and 2007. 2011.

5- Amadeo, Kimberly. “The Cause of Income Inequality in America.” The Balance, 20 Apr. 2022, www.thebalancemoney.com/income-inequality-in-america-3306190.

6- Stewart, Emily. “Stock Buybacks, Explained.” Vox, 2 Aug. 2018, www.vox.com/2018/8/2/17639762/stock-buybacks-tax-cuts-trump-republicans.

7- Reich, Robert. “Inequality Media with Robert Reich.” Inequality Media with Robert Reich, 2014, www.inequalitymedia.org/does-trickledown-economics-actually-work?gad_source=1&gclid=CjwKCAiAudG5BhAREiwAWMlSjPPwf5DhY7rUHtt00iJy4OFu3OkNnp2RFAgSVAm1UzPyOYfErfEtaBoCfvQQAvD_BwE. Accessed 14 Nov. 2024.

8- Anderson, Sarah . “Executive Excess 2024.” Institute for Policy Studies, 29 Aug. 2024, ips-dc.org/report-executive-excess-2024/.

9- Bieg, Carla. “Disruption in the US Tech Sector: Layoffs, Stock Buybacks, and Business Plan Pivots - Atlantik-Brücke E.V.” Atlantik-Brücke E.V., 23 Feb. 2023, www.atlantik-bruecke.org/disruption-in-the-us-tech-sector-layoffs-stock-buybacks-and-business-plan-pivots/. Accessed 14 Nov. 2024.